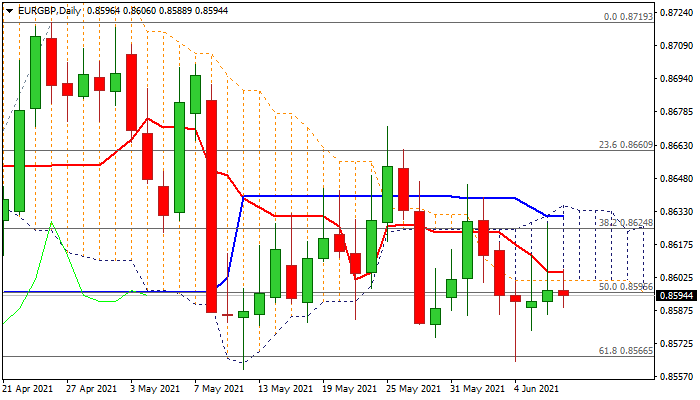

Sideways mode on mixed signals extends but near-term bias remains negative

The cross edged lower in European trading on Wednesday as pound was elevated by hawkish comments from BoE chief economist Haldane but remains within the range that extends into fourth straight day.

Last Friday’s long-tailed Doji candle and long upper shadows of Mon/Tue daily candles add to signs of indecision, as positive signals about UK economic recovery were overshadowed by speculation that the government may delay the final lift of pandemic restrictions (scheduled for June 21) for up to four weeks.

Technical studies on daily chart maintain bearish tone, as near-term action remains capped by thickening daily cloud and momentum is negative, but bears require confirmation on firm break of cracked Fibo support at 0.8566 (61.8% of 0.8472/0.8719 upleg) to signal continuation of descend from 0.8719 (Apr 26 high).

Daily cloud base offers strong resistance at 0.8601, reinforced by daily Tenkan-sen but stronger bullish signal could be expected only on lift through daily Kijun-sen (0.8630) and daily cloud top (0.8635).

Res: 0.8601; 0.8620; 0.8635; 0.8652

Sup: 0.8588; 0.8566; 0.8530; 0.8485