ECB policy meeting and US CPI data eyed for fresh direction signals

The Australian dollar remains within a narrow range for the third straight day after last week’s sharp fall was quickly reversed, keeping the price at familiar levels.

Positive signals from lower US yields was offset by dovish stance from RBA, with expectations that inflation would remain subdued and keep loose monetary policy in play for prolonged period of time.

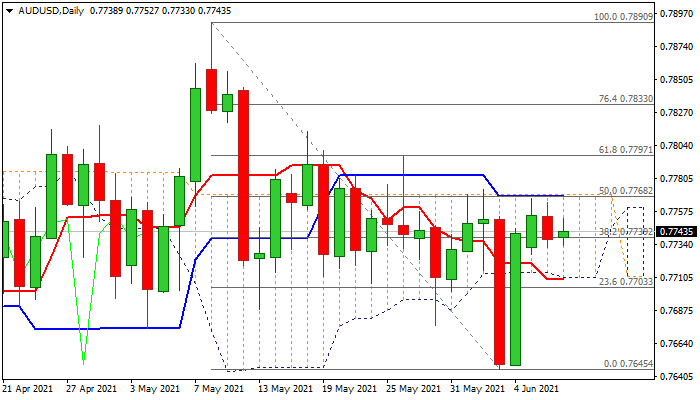

Near-term action is moving within daily cloud (spanned between 0.7710 and 0.7768) with the cloud base being reinforced by daily Tenkan-sen and the upper boundary -cloud top – strengthened by daily Kijun-sen.

Break of either side would provide fresh direction signal, but rising negative momentum on daily chart and overbought stochastic suggest that near-term action remains bearishly aligned.

Investors focus on Thursday’s ECB policy meeting and US inflation data which could give more hints about interest rate expectations and generate fresh signals.

Res: 0.7752; 0.7768; 0.7797; 0.7813

Sup: 0.7730; 0.7710; 0.7677; 0.7645