US inflation data and ECB meeting would provide more clues about monetary policies and metal’s direction in the near future

Spot gold remains in red for the second day as dollar maintains firm tone, although the downside remains limited as markets await ECB policy meeting and US inflation report to get more information about possible steer in monetary policies and the future of economic support measures.

US producer prices rose to central bank’s target, but the Fed sees the increase as transitory that’s the main argument for keeping ultra-loose policy.

Scenario of CPI rising well above expectations in May could give Fed more reasons for tightening current dovish policies earlier than expected that would lift the yellow metal, often used as a hedge against inflation.

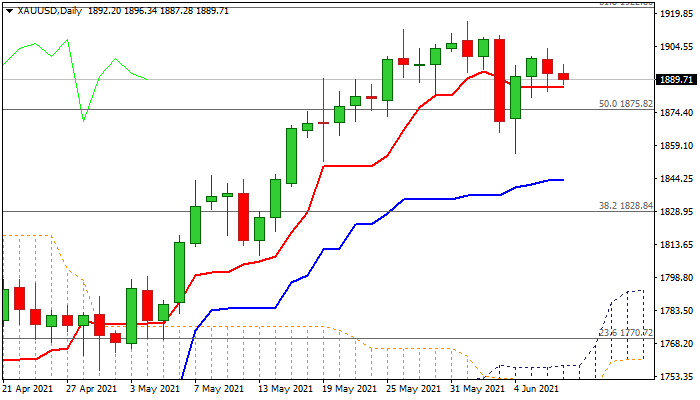

Solid technical support lays at $1885 (daily Tenkan-sen) with near-term action expected to remain biased higher above this level.

Conversely, break of $1885 pivot would risk further weakness and expose breakpoints at $1855/43 (June 4 trough / daily Kijun-sen).

Res: 1896; 1903; 1916; 1922

Sup: 1885; 1875; 1855; 1843