Solid supports at 115 zone hold for now; Fed Powell’s testimony in focus

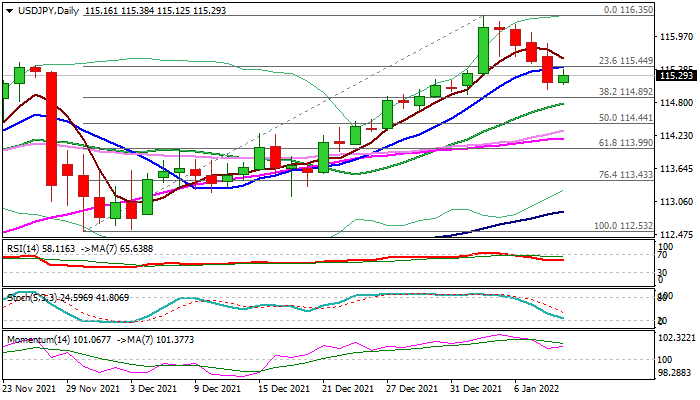

The dollar regained traction in early Tuesday after being in red four days, as pullback from 2022 high (116.35) faces strong headwinds at 115.00 support zone (psychological / Fibo 38.2% of 112.53/116.35 / rising 20DMA).

The corrective dip should be ideally contained here to keep larger bulls intact for fresh push higher.

Daily studies keep positive momentum that supports the notion, however, rebound from correction low (115.04) needs an extension and close above daily Tenkan-sen (115.62) to generate positive signal.

Caution on break of 115 zone which could trigger stops and open way for deeper pullback towards Fibo supports at 114.44 and 113.99 (50% and 61.8% retracement of 112.53/116.35 respectively).

Traders focus on today’s key event, Fed Chair Powell’s testimony, which is expected to provide more clues on timing and pace of monetary policy normalization.

Res: 115.44; 115.62; 116.04; 116.35

Sup: 115.00; 114.89; 114.79; 114.44