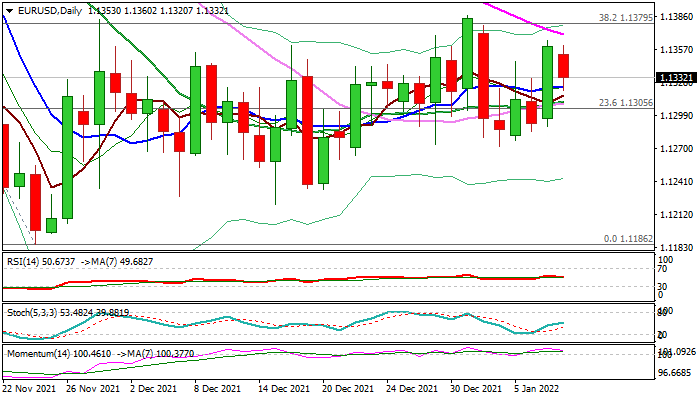

The base of thick daily cloud continues to cap and keep larger bears intact

The Euro dips in European trading on Monday after last Friday’s post-NFP advance faced strong headwinds at the base of thick falling daily cloud (1.1361).

Extended consolidation of a larger downtrend from 2021 high (1.2349) was repeatedly capped by daily cloud base, suggesting that the upside is limited, while the action remains weighed by the cloud.

Although the daily techs still maintain bullish momentum, warning signals come from a weekly chart, as formation of 20/200DMA death-cross, negative momentum and overbought stochastic, warn that larger picture is bearish and larger downtrend is likely to resume after consolidation.

Initial supports lay at 1.1272 (Jan 4 low) and 1.1221 (Dec 15 low), guarding pivot at 1.1186 (2021 low) loss of which to signal bearish continuation and risk drop towards 1.10 zone.

Daily cloud base, falling 55DMA (1.1369) and Fibo 38.2% of 1.1692/1.1186 bear-leg (1.1379) offers strong barriers which should keep the upside limited and maintain overall bearish structure.

Res: 1.1361; 1.1379; 1.1400; 1.1439

Sup: 1.1324; 1.1272; 1.1221; 1.1186