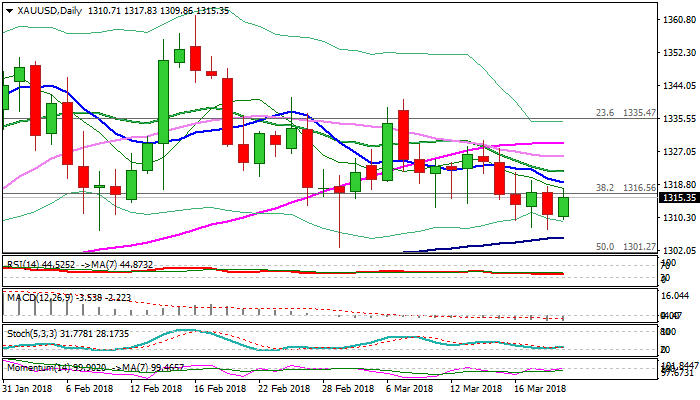

SPOT GOLD bounces after bears approached key supports at $1305/02; Fed decision is in focus for fresh direction signals

Spot Gold trades higher on Wednesday after hitting three-week low at $1307 on Tuesday, where broader bears stalled on approach to key supports at $1305 (100SMA) and $1302 (01 Mar spike low).

Overall structure remains bearish and looks for eventual break through pivotal $1300 support zone, which also marks the mid-point of larger $1226/$1366 ascend.

Today’s bounce could be seen as positioning for fresh downside as Fed is widely expected to increase interest rates on its two-day meeting which ends today. However, traders will be looking for hints about Fed’s next steps, as hawkish tone would signal more aggressive approach to the interest rate policy and possible four hikes in 2018, compared to projected three hikes, which would boost the greenback and send gold price lower.

Softer tone from Fed would ease current bearish pressure on the yellow metal and open way for stronger recovery and test of a cluster of MA barriers which lies between $1319 and $1329.

Firm break here will be needed to sideline existing bears and signal stronger recovery.

Res: 1319; 1322; 1325; 1329

Sup: 1307; 1305; 1302; 1300