WTI OIL – bulls extend into sixth straight day; EIA report eyed for fresh signals

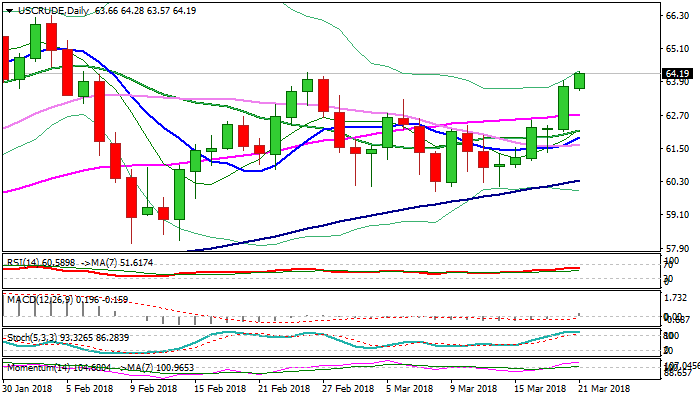

WTI oil continues to trend higher, moving in uninterrupted rally which extends into sixth straight day on Wednesday, with fresh extension probing through previous high of 26 Feb at $64.22.

Concerns about renewed tensions in the Middle East and healthy demand keep oil price supported.

Also, Tuesday’s API crude stocks report showed unexpected fall in crude inventories by 2.73 million barrels vs forecasted build of 3.2 million barrels.

Firmly bullish daily techs remain supportive, with close above $64.22 barrier needed to signal full retracement of $64.22/$59.94 bear-leg and open way for further retracement of larger $66.64/$58.06 descend.

However, strongly overbought slow stochastic suggests bulls may show stronger hesitation at $64.22 pivot, with stronger dips not ruled out.

Former high at $63.26 (06 Mar) marks solid support, with extended downticks to be contained by rising 5SMA ($62.71).

Release of EIA crude inventories report is in focus today, with forecast for 2.6 million barrels build of crude stocks. Repeated surprise on fall in crude inventories today would be strong boost for bulls.

Firm break above $64.22 would expose $64.62 (Fibo 76.4%) and $65.38 (05 Feb high) in extension.

Performance of the US dollar after FOMC decision will be also closely watched, as scenario of stronger dollar on hawkish Fed would also affect current oil bulls.

Res: 64.62; 65.00; 65.38; 65.85

Sup: 63.57; 63.36; 63.26; 62.71