SPOT GOLD bounces on fresh risk aversion

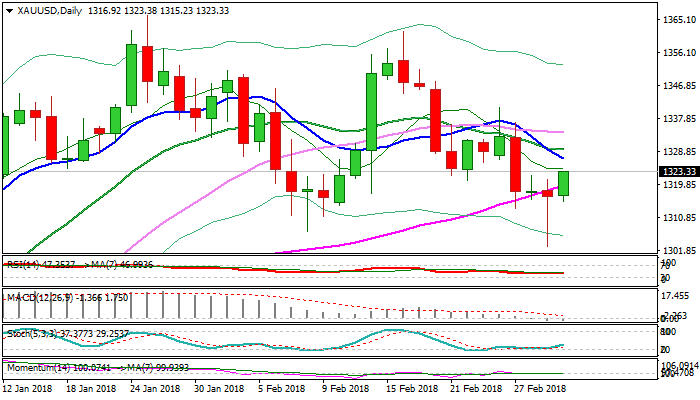

Spot Gold stands at the front foot on Friday after bouncing from two-month low at $1303 on Thursday, as news about US tariffs on imported metals caused turmoil in the markets and prompted investors into safer assets.

Fresh recovery attempts sideline downside risk which was built on strong fall in previous sessions and signal gold price could climb higher in new risk aversion environment.

Reversal signal is developing after Thursday’s long-tailed Doji which was the second consecutive Doji candle and signaling strong indecision.

Recovery probes through initial barrier at $1322 (Wednesday’s high), for test of daily Tenkan-sen ($1325) but needs to emerge above daily cloud (cloud top lies at $1329) to confirm reversal and expose next pivotal barrier at $1340 (26 Feb lower top / near Fibo 61.8% of $1361/$1303 bear-leg).

Broken 55 SMA now acts as support ($1318) and should keep the downside protected.

Res: 1325; 1329; 1332; 1340

Sup: 1318; 1315; 1313; 1307