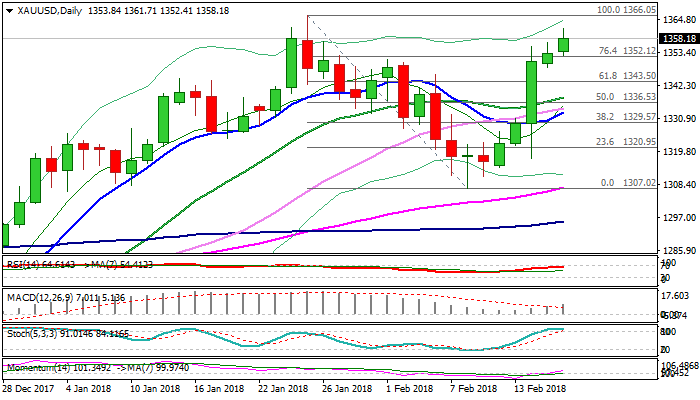

SPOT GOLD – bulls are looking for final push through key $1366 barrier

Spot Gold is holding just under new three-week high at $1361, maintaining strong bullish sentiment and focusing key near-term barrier at $1366 (25 Jan peak, the highest since early Aug 2016).

The yellow metal is strongly supported by weak dollar which came under increased pressure on mounting concerns about deficit US budget and current account.

Projections for current account deficit are for nearly $1 trillion in 2019 which could have further strong negative impact on the greenback.

Gold could extend its broader uptrend towards targets at $1375 (early July 2016 peak) and $1391 (mid-March 2014 high) on firm break above $1366 pivot.

The metal is on track for strong bullish weekly close (the biggest one-week gains since Feb 2016), which would provide further boost to existing bullish structure.

However, bulls may show hesitation and enter consolidation phase ahead of $1366 pivot as slow stochastic turned sideways in deeply overbought territory and could produce bearish signal on reversal.

Former lower top at $1351 (also Fri session low) marks initial support, with deeper dips expected to find support at $1343 (broken Fibo 61.8% of $1366/$1307 pullback).

Res: 1361; 1366; 1375; 1380

Sup: 1351; 1346; 1343; 1336