SPOT GOLD – cautious trading on political uncertainty in the US show no clear n/t direction

Spot Gold ticked higher on Wednesday as dollar came under pressure after sudden dismissal of US Secretary of State, but limited upside action was seen so far as traders remain cautious in light of new political situation as well as rising fears about US tariffs plan.

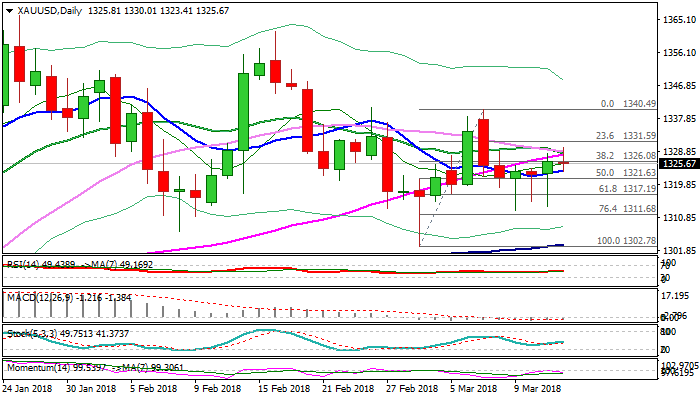

Positive signals were seen after triple strong downside rejection in recent sessions, but recovery attempts lacked momentum for stronger upside and were capped by cluster of MA’s (55/30/20SMA) at $1328 zone.

Weakening momentum studies on daily chart keep the downside vulnerable of renewed attacks at recent spike lows at $1313 zone, loss of which would generate stronger bearish signal.

Conversely, firm break above $1328 barriers would shift n/t focus towards daily cloud top ($1338).

Release of US PPI and retail sales data today could provide fresh direction signal.

Res: 1328; 1332; 1338; 1340

Sup: 1323; 1319; 1317; 1313