Copper rallies strongly after strong Chinese data; bulls may face strong headwind from daily cloud top

Copper was strongly higher on Wednesday, driven by strong Chinese industrial production data which boosted the sentiment.

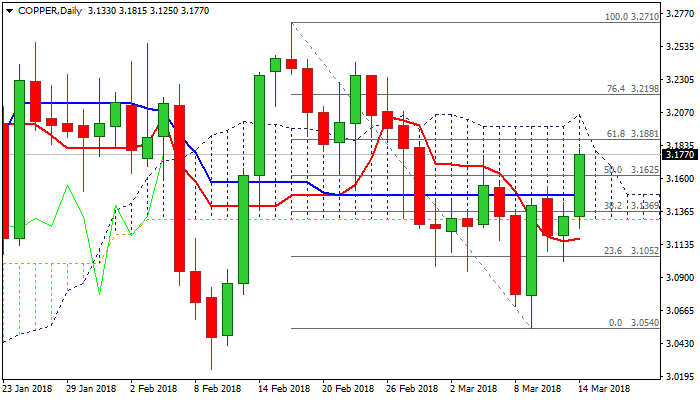

Fresh bullish acceleration above previous high at $3.1765 (06 Mar) hit new two-week high at $3.1815 and pressuring pivotal barrier at $3.1888 (Fibo 61.8% of $3.2710/$3.0540 descend).

Improved structure on daily chart as MA’s turned into bullish configuration, favors further upside, but bulls may be limited as momentum studies are weak and top of narrowing daily cloud in $3.20 area weighs.

Initial signs of stall could be expected on rejection under cloud top and return below broken 20SMA ($3.1669), while stronger bearish signal would be generated on return and close below 100SMA ($3.1510).

Signals of bullish continuation need firm break and close above daily cloud to signal further retracement of $3.2710/$3.0540 fall.

Res: 3.1815; 3.1881; 3.2000; 3.2198

Sup: 3.1669; 3.1510; 3.1312; 3.1178