SPOT GOLD falls on tariffs announcement; break below $1292 pivot to spark further weakness

Spot Gold price fell after US tariff announcement, extending weakness from Thursday’s high at $1309 where rally was rejected.

The dollar benefited from dovish ECB on Thursday, sending the yellow metal price down, with additional pressure coming from new US tariffs on goods imported from China.

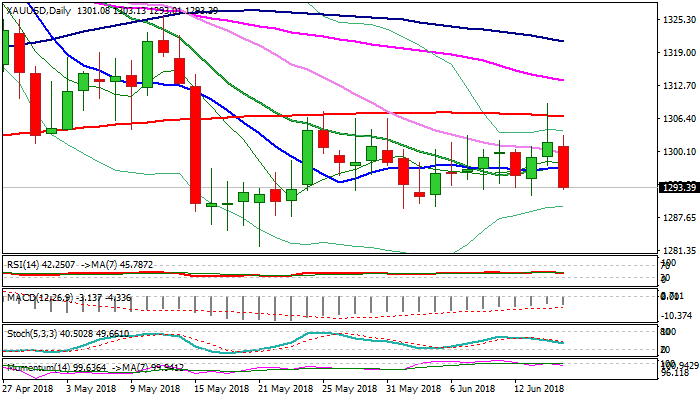

Gold price reversed from $1309 high on Thursday, leaving daily candle with long upper shadow after false break above 200SMA, which was initial negative signal. Fresh extension lower on Friday pressures pivotal support at $1292 (Fibo 61.8% of $1282/$1309 ascend, break of which would generate strong bearish signal.

Bearish daily techs maintain negative tone for extension towards $1289 higher base.

Broken converged 10/20SMA’s mark solid barrier at $1296, with extended upticks expected to hold below psychological $1300 barrier, reinforced by 30SMA.

Res: 1296; 1300; 1303; 1306

Sup: 1292; 1289; 1285; 1282