WTI OIL stands at the back foot on concerns about production increase

WTI oil holds in red on Friday as on rising concerns among market participants that OPEC could vote to increase output at its meeting next week.

Shortage in supplies from Iran and Venezuela pressures main world oil producers to think of increasing production.

Initial idea of Saudi Arabia for output increase by 500,000 to 1 million barrels, gradually or at once, will be very likely on agenda on OPEC’s 22 June meeting in Vienna.

Oil price could fall if OPEC start increasing the output, which would be the first time since main oil producers agreed to reduce oil production by 1.8 million barrels in 2017, with the deal expiring at the end of 2018, if not extended.

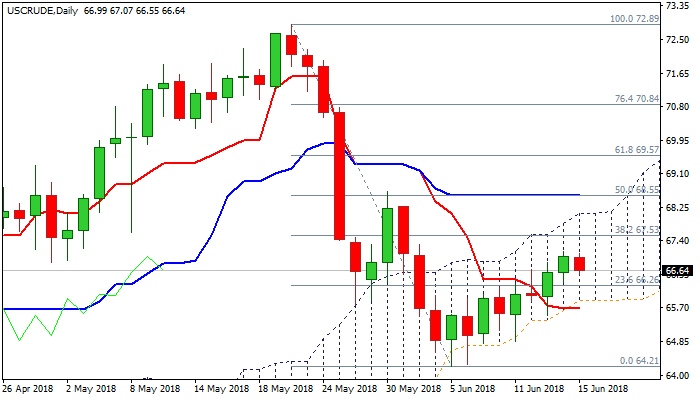

Today’s easing so far looks like consolidation as oil price is in uptrend from $64.21 (05 May low) and maintaining strong momentum.

The bull-leg remains supported by the base of rising daily cloud and lays at $65.90 today, marking key support.

Corrective dips are expected to find footstep at cloud base to keep bullish structure intact.

At the upside, cloud top at $68.09, marks the upper pivot, break above which is needed to generate strong signal for bullish continuation.

Res: 67.14; 67.53; 68.09; 68.55

Sup: 66.55; 65.90; 65.51; 64.84