Sterling extends advance on growing expectations for more dovish Fed

Cable continues to benefit from rising expectations for more dovish Fed after US labor data on Friday added to signals that the central bank would further ease the pace of policy tightening, increasing the possibility for 25 basis points hike in the next meeting and lowering expectations for 0.5% hike.

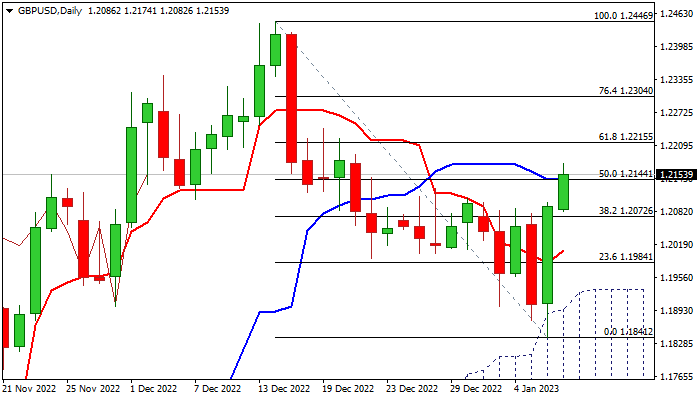

Sterling rallied 1.6% on Friday, after US labor data added to a risk sentiment, making the biggest daily rally since Nov 10, with formation of bullish engulfing pattern on a daily chart, generating initial bullish signal.

Monday’s extension hit the highest since Dec 21 and broke through Fibo barrier at 1.2144 (50% retracement of 1.2446/1.1841), signaling formation of a higher low at 1.1841, after the pullback from Dec 14 high (1.2446) was contained by rising thick daily cloud.

Improving daily studies (momentum is about to break into positive territory and moving averages returned to bullish setup) underpin near-term action, which looks for a daily close above broken Fibo level (1.2144) to keep bulls intact for further retracement of 1.2446/1.1814 pullback.

Next pivots lay at 1.2215 (Fibo 61.8%) and 1.2304 (Fibo 76.4%) violation of which would expose key barrier at 1.2446.

Extended dips should find ground above 1.2100 zone (last week’s multiple highs) to maintain bullish bias.

Res: 1.2174; 1.2215; 1.2241; 1.2304

Sup: 1.2100; 1.2072; 1.2044; 1.2012