Fresh advance signals an end of a shallow correction

The Euro rises further in Asian / early European trading on Monday, lifted by renewed risk sentiment, which deflates the dollar, as markets expect that the Fed would further ease the pace of rate hikes in the next policy meeting.

the single currency rose almost 1.2% on Friday, after US labor report showed that US labor market is not as tight as initially estimated that adds to the notion of further easing of the pace of Fed policy tightening.

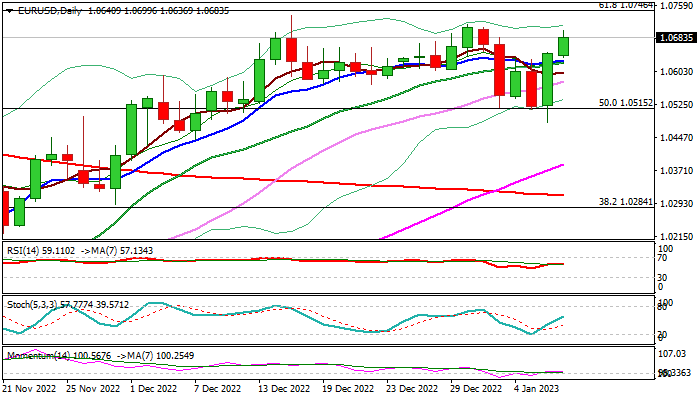

Friday’s bullish engulfing pattern underpinned recovery, with today’s rally through pivotal barrier at 1.0625 (converged 10/20DMA’s) further firmed the structure and signal that shallow 1.0713/1.0483 correction might be over.

Daily chart studies show 14-d momentum returned to positive territory and Stochastic / RSI are heading north that supports the action, which needs a clear break of pivotal Fibo barrier at 0.7046 (61.8% of 1.1494/0.9535) and a lower top of May 30 (1.0786) to signal continuation of a broader recovery from 0.9535 (2022 low of Sep 28).

Fresh bulls are expected to remain intact while near-term action stays above 1.0625 (converged 10/20DMA’s).

Res: 1.0711; 1.0736; 1.0746; 1.0786

Sup: 1.0625; 1.0579; 1.0515; 1.0483