Sterling remains in red after dovish BoE

Cable remains in red for the second day, as dovish BoE faded hopes that the central bank would send initial signals of earlier than expected start of policy tightening due to surging inflation.

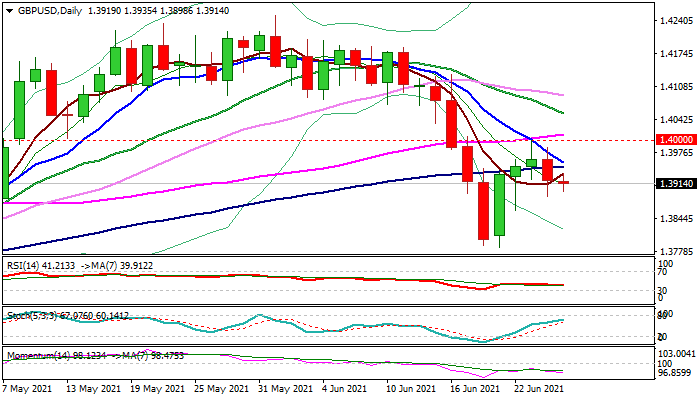

Reversal pattern is forming on daily chart after three-day rebound stalled at 1.4000 zone and subsequent weakness signaling that short recovery phase might be over.

Negative momentum started to rise again on daily chart while moving averages returned to bearish setup, maintaining pressure, along with thick daily cloud (base lays at 1.3951)

Bears need close below 1.3893 (cracked Fibo 50% of 1.3786/1.4000 recovery leg) to add to reversal signals.

Investors await release of UK CBI retail sector report (June f/c 14 vs May 18) and US core PCE price index which tracks the average inflation increase and is expected to rise to the highest in 29 years in June.

Res: 1.3935; 1.3951; 1.3986; 1.4000

Sup: 1.3893; 1.3868; 1.3837; 1.3786