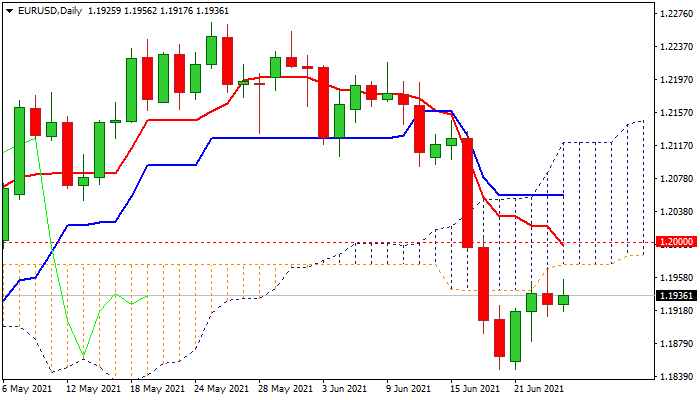

Euro regains traction on solid data but near-term outlook remains negative below daily cloud / 200DMA

The Euro is standing at the front foot on Thursday, inflated by upbeat German data and lower but above expectations US weekly jobless claims which increased pressure on dollar.

The single currency regained traction after two-day bounce from 1.1847 (June 18/21 lows) showed signs of stall on Wednesday’s bearish candle with long upper shadow.

Technical studies on daily chart are in bearish setup with 14-d momentum remaining deeply in negative territory and turning south again, while formation of 10/200DMA death-cross weighs on near-term action.

The downtrend from 1.2266 (May 25 peak) is expected to remain intact while upticks stay capped under key barriers at 1.1974 (base of thick daily cloud) and 1.1993/1.2000 (200DMA / psychological) and point to a healthy correction before bears resume.

Only firm break of 1.2000 resistance zone would sideline bearish pressure and shift near-term focus higher.

Res: 1.1956; 1.1975; 1.1992; 1.2007

Sup: 1.1911; 1.1880; 1.1847; 1.1836