Sterling remains in red for the second day following upbeat US NFP

Cable remains under pressure on Monday and probes again through 100DMA (1.3508) which contained Friday’s drop (the pair was down 0.5% for the day) as pound came under increased pressure from better than expected US jobs data which inflated dollar.

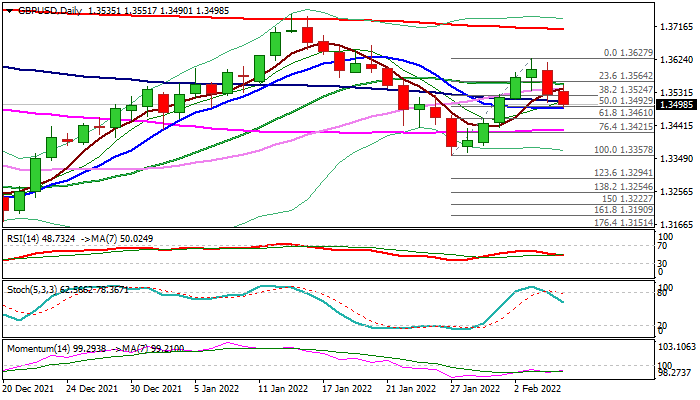

Fresh weakness cracks next pivotal supports at 1.3497/92 (daily cloud top / 50% retracement of 1.3357/1.3627 rally) with daily close below here to further weaken near-term structure and confirm lower top at 1.3627 (Feb 3 high) and expose supports at 1.3461/21 (Fibo 61.8% and 76.4% of 1.3357/1.3627 respectively).

Daily RSI is heading south and 14-d momentum remains in the negative territory, adding to bearish signals.

Session high at 1.3552 (reinforced by 20DMA) marks solid resistance which should keep the upside protected and keep near-term bears in play.

Res: 1.3524; 1.3552; 1.3564; 1.3600

Sup: 1.3490; 1.3461; 1.3421; 1.3400