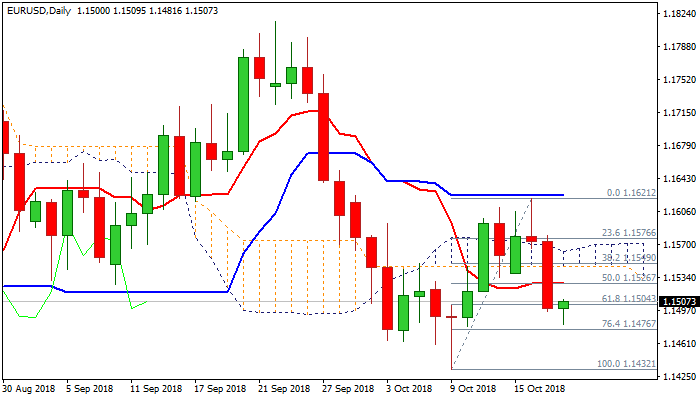

Strong bearish signals on close below daily cloud / Fibos for test of key 1.1432 support; cloud base to cap upticks

The Euro extended weakness to new one-week low at 1.1418 in early European trading on Thursday but bears face headwinds from nearby target at 1.1476 (Fibo 76.4% of 1.1432/1.1621 upleg).

Strong fall on Wednesday (the biggest one-day loss in Oct), fueled initially by rise in Italian yields and boosted by hawkish Fed, generated bearish signals on extension deeply below daily cloud and close below 1.1504 (Fibo 61.8% of 1.1432/1.1621).

Bearishly aligned daily techs, along with US/EU interest rate divergence, Italy issue still being on the table and vulnerable German political situation, continuing to weigh.

Bears could extend to key near-term support at 1.1432 (09 Oct spike low), with daily cloud base expected to cap corrective upticks and maintain bearish tone.

Res: 1.1526; 1.1545; 1.1562; 1.1580

Sup: 1.1476; 1.1463; 1.1432; 1.1400