Strong recovery rejections and fresh strength of dollar keep the pair in red

The Euro eased in early European trading on Monday as dollar regains traction and leaves a little space for Euro’s recovery after steep fall in past two weeks.

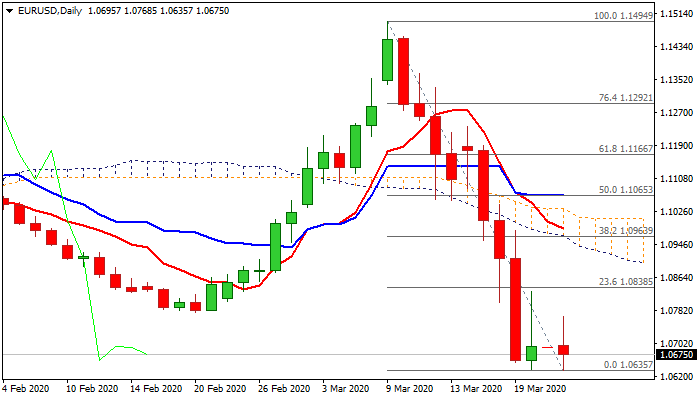

Strong recovery rejection on Friday at 1.0830 and inability to hold above 1.07 level adds to negative signals, as massive bearish weekly candle (4.4% weekly fall) weighs heavily.

Bears focus Apr 2017 trough at 1.0570 and Feb 2017 low at 1.0493, with Jan 2017 low at 1.0340, with full retracement of 1.0340/1.2555 (Jan 2017/Feb 2018 rally) seen as likely scenario.

Former low at 1.0778 (20 Feb) so far caps upticks and keep bears intact, guarding next pivots at 1.0840 (Fibo 23.6% of 1.1494/1.0635) and 1.0939 (daily cloud base).

Worsening crisis over corona virus pandemic and growing signals that the global economy is entering recession, continue to prompt traders into safe-haven US dollar, keeping the single currency in red.

Res: 1.0700; 1.0725; 1.0778; 1.0840

Sup: 1.0635; 1.0570; 1.0493; 1.0454