The dollar index is on track for the first close in red after 8 days of uninterrupted rally

The dollar index is holding in red on Friday for the first time in nine days, as the greenback eased after the measures of US policymakers as well as other world central banks and governments, started to positively impact markets and improved sentiment.

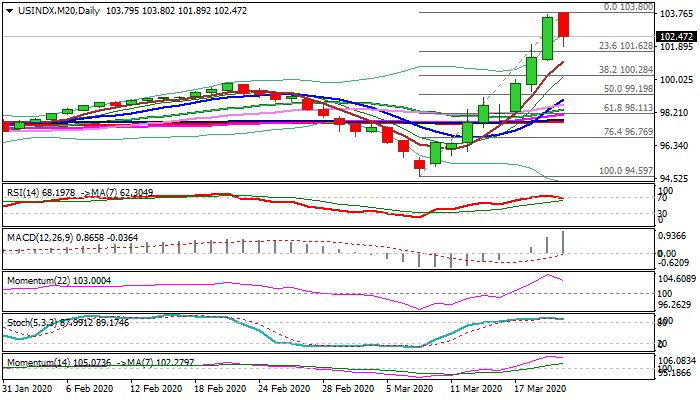

The index pulled back after rally stalled at 103.80 (Jan 2017 peak), suggesting that attempts for final break through this key barrier would be delayed.

However, the dollar remains the most wanted instrument nowadays and demand is still strong as signs that the world entered recession on corona virus pandemic could further boost its safe-haven appeal.

The index is on track to end today’s trading in red after record weekly advance of over 4%, that could signal deeper correction.

Profit-taking and restored confidence would support the action.

Traders focus turns towards initial supports at 101.62 (Fibo 23.6% of 94.59/103.80) and rising 5DMA (101.04), violation of which would risk deeper dip and test of key supports at 100.28 (Fibo 38.2%) and psychological 100 level.

Only firm break of the latter would put bulls on hold and trigger stronger correction.

On the other side, massive weekly bullish candle continues to underpin, with bullish bias expected to remain intact while the price stays above 100 level.

Res: 103.80; 105.00; 107.00; 107.49

Sup: 101.89; 101.62; 101.04; 100.28