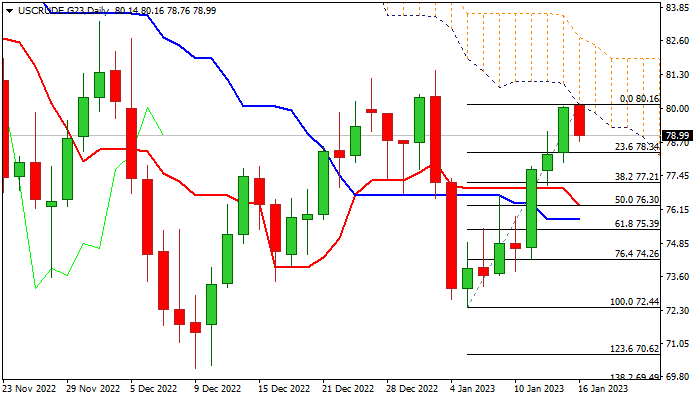

Strong recovery to pause under falling daily cloud

The WTI oil price edges lower after briefly extending last week’s 2.2% advance, after the action faced strong headwinds at $80 resistance zone (psychological / base of falling and thickening daily cloud).

Overall near-term structure is bullish as China’s reopening after strict Covid measures brightened demand outlook and improved the sentiment.

Overbought conditions on daily chart prompted some profit taking after last week’s rally, with corrective dips to be ideally contained at $77 zone (Fibo 38.2% of $72.44/$80.14 / 20DMA) ahead of fresh attack at key barriers, break of which would expose targets at $82.60/73 (100 DMA / daily cloud top).

Only dip below $76.30 (Fibo 50% / 10DMA) would weaken near-term structure and risk deeper pullback.

Res: 80.00; 80.13; 81.46; 82.60

Sup: 78.32; 77.12; 76.30; 75.38