The dollar remains firmly in red after US data and looks for repeated attack at key support

The dollar index accelerated lower on Thursday after data showed stronger than expected rise in retail sales in June, Philly Fed Manufacturing index beat expectations and continuing jobless claims falling further and holding below 20 million for the fourth straight month.

The data fueled risk sentiment but investors remain cautious as rising Covid-19 cases warn of slowing economic recovery after the crisis caused by pandemic lockdown.

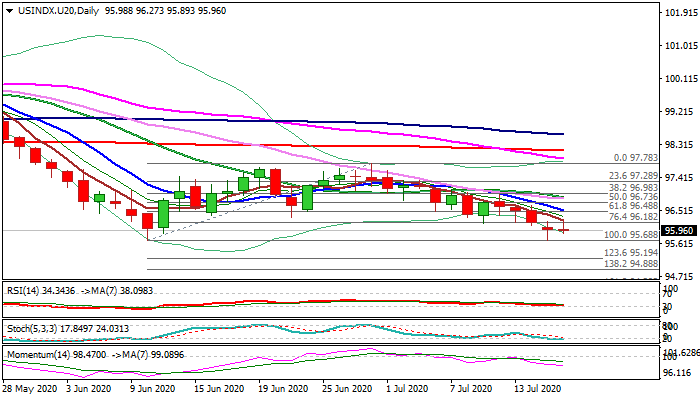

Daily chart shows bears in control and aiming towards key support at 95.68 (10 June low) which was neared on Wednesday’s dip to 95.70.

Long upper shadow of today’s candle is negative signal, following Thursday’s Doji which signaled hesitation on approach to key support level.

Bears look for close below cracked 95.98 support (50% retracement of larger 88.14/103.80 advance) to confirm negative stance.

Violation of 95.68 pivot would risk dip towards 94.59 (2020 low, posted on 8 March).

Bearish structure is expected to remain intact while the price action stays below broken Fibo 76.4% level at 96.18, while only break above falling 10DMA (96.51) would sideline bears.

Res: 96.18; 96.51; 96.73; 96.84

Sup: 95.89; 95.68; 95.19; 94.88