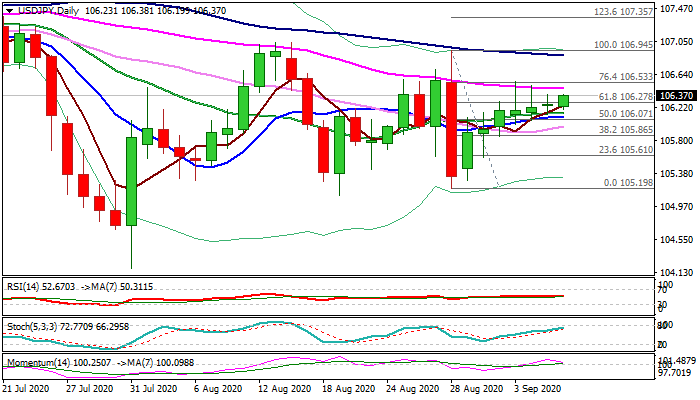

The pair probes again through key Fibo barrier, following multiple failures in past few sessions

The pair edged higher on Tuesday, as dollar was inflated by fresh weakness of sterling and Euro on growing fears that the Britain would exit the EU without a trade deal.

Fresh advance comes after triple Doji candles, with two of them having long upper shadows that points to strong headwinds bulls are facing, however, the near-term action remains in slight but steady ascend.

Bulls need eventual close above 106.27 (Fibo 61.8% of 106.94/105.20) after four consecutive failures and extension above falling 55DMA (106.46), which capped the action in past two days, to signal continuation and open way for test of key barriers at 106.87 (100DMA) and 106.94/107.04 (13/28 Aug highs).

Daily MA’s (10/20/30) are in bullish setup and support the advance, along with rising stochastic, but fading positive momentum requires caution.

Converging 10/20DMA’s (106.09/14 respectively) offer solid support which is required to continue to hold and keep near-term bullish bias.

Res: 106.46; 106.55; 106.94; 107.04

Sup: 106.27; 106.09; 105.98; 105.85