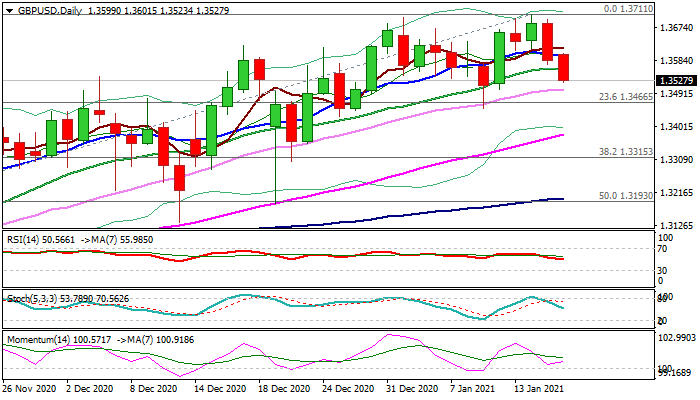

Top formation risks deeper pullback

Cable extends lower in early Monday, following 0.75% drop on Friday, pressured by profit-taking after repeated failures at 1.3700 zone and comments from US Treasury nominee Yellen that US does not seek weaker dollar.

Fresh weakness broke below 20DMA (1.3560), softening near-term structure, with daily close below here to signal top and increase risk of testing pivotal supports at 1.3466/51 (Fibo 23.6% of 1.2675/1.3711 / Dec 11 trough).

Daily moving averages (5/10/20) turned to negative setup, but larger bulls remain in play and only break of 1.3466/51 pivots would sideline bulls and signal deeper pullback towards 1.3377 (rising 55DMA) and 1.3315 pivot (Fibo 38.2%) in extension.

Broken 10DMA (1.3596) caps today’s action and keeps fresh bears in play.

Res: 1.3557; 1.3596; 1.3618; 1.3670

Sup: 1.3503; 1.3466; 1.3451; 1.3377