Upbeat UK retail sales data add to positive post-BoE tone

Cable is holding positive tone in early Friday following Thursday’s rally to 1.3374 (three-week high) after surprise BoE rate hike.

Upbeat UK retail sales data (Nov 1.4% m/m from 1.1% in Oct and vs 0.8% f/c) provide additional support to sterling, along with UK Liberal Democrats winning a seat from PM Johnson’s party.

On the other side, record highs of new Covid cases in Britain weigh and partially offset positive impact after BoE.

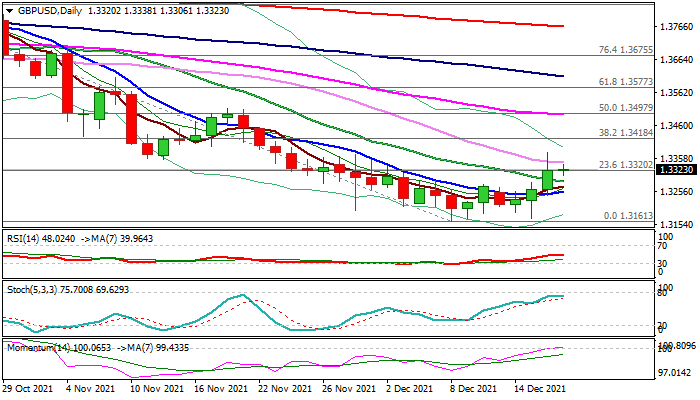

Technical studies are improving on daily chart, as momentum is breaking into positive territory and action rose and closed above 20DMA on Thursday.

Fresh bulls eye next pivotal barrier at 1.3418 (Fibo 38.2% of 1.3834/1.3161 fall), break of which would further strengthen near-term structure and generate initial reversal signal, after larger fall was contained by 200WMA).

Repeated close above 200DMA (1.3286) to keep bullish bias.

Res: 1.3337; 1.3374; 1.3418; 1.3469

Sup: 1.3306; 1.3286; 1.3255; 1.3190