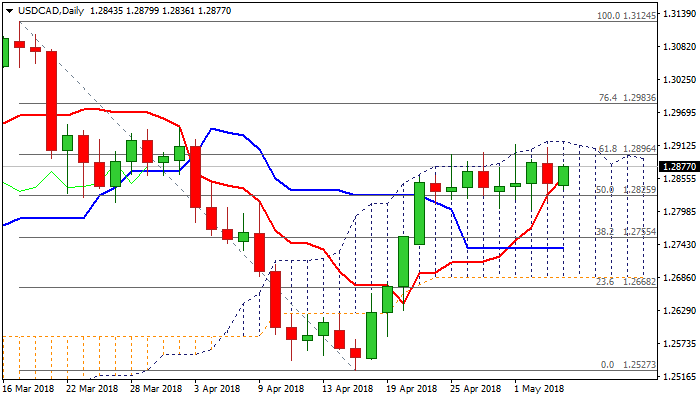

USDCAD seeks firmer signal for eventual break out of two-week congestion

The pair remains in directionless mode for the second straight week and continues to trade within choppy range, capped by daily cloud top.

Recovery leg from 1.2527 (17 Apr low) shows strong signs of stall at pivotal barriers at 1.2896 (Fibo 61.8% of 1.3124/1.2527 bear-leg) and 1.2918 (daily cloud top), but so far lacking reversal signals as downside attempts were limited and daily MA’s remain in full bullish setup, helped by growing bullish momentum.

Bulls need a catalyst to spark fresh acceleration higher for eventual break through strong barriers and attack at psychological 1.30 resistance.

On the other side, bearish signal could be expected on final break below range floor, reinforced by 55SMA (1.2811), but bears would face a cluster of supports between 1.2772 and 1.2635, consisting of parallel-running 30; 20; 100 and 200SMA’s and base of daily cloud.

Today’s release of US jobs data could provide fresh direction signal.

Res: 1.2896; 1.2918; 1.2943; 1.2983

Sup: 1.2811; 1.2772; 1.2738; 1.2684