USDJPY- bears hold grip for attack at psychological 140 support

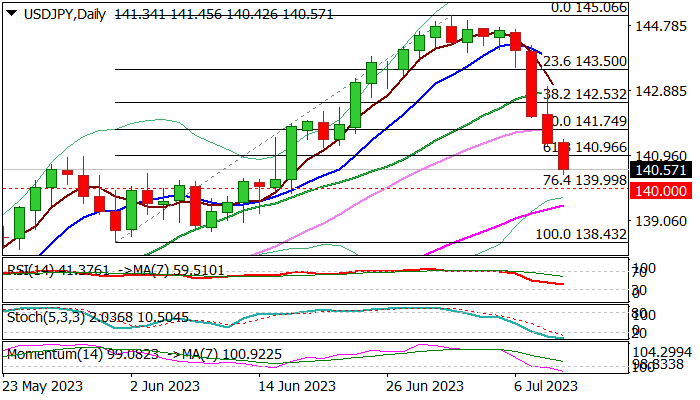

USDJPY extends steep fall into fourth straight day, with fresh acceleration in early Tuesday’s trading pressuring psychological 140 support (also Fibo 76.4% of 138.43/145.06 upleg).

Technical picture on daily chart weakened as 14-d momentum broke into negative territory on Monday and MA’s (10/20/30 d) turned to bearish setup, keeping the downside at risk.

Attack at 140 zone looks likely, however, deeply oversold stochastic warns of increased headwinds and suggests that break lower at first attempt is quite unlikely.

Consolidation / correction likely to precede fresh push lower, with initial resistance at 140.96 (broken Fibo 61.8%) and daily Kijun-sen (141.91) expected to cap extended upticks to keep bears in play.

Firm break of 140 pivot to expose key supports at 138.43/44 (June 1 higher low / top of thick and rising daily Ichimoku cloud), violation of which to signal reversal and open way for deeper correction of larger uptrend from 129.64 (Mar 24 low).

Res: 140.96; 141.45; 141.74; 141.91

Sup: 140.00; 139.51; 138.75; 138.43