USDJPY – consolidation above new 16-mth low may extend with limited upside; key events due this week are in focus

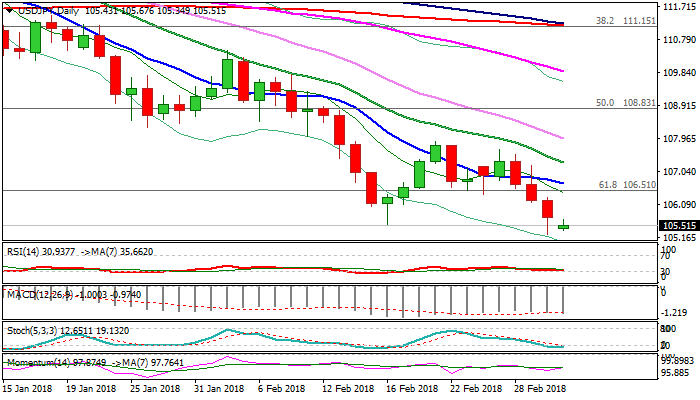

The pair ticked higher in early Monday’s trading, consolidating above new 16-montgh low at 105.24, posted on Friday.

Strong three-day acceleration from 27 Feb lower top at 107.67, cracked key support at 105.54 (16 Feb low) but failed to close below it on initial attempt.

The dollar came under strong pressure last week on decision of President Trump to impose tariffs on imported metals which raised fears of trade war and hawkish stance from BoJ governor Kuroda, who signaled tightening monetary policy if CPI reaches target, which further inflated yen.

Overall, near-term outlook remains negative and bears focus round-figure support at 105, break of which would spark further weakness towards 103.63 (Fibo 76.4% of 98.99/118.66 ascend) and would unmask psychological 100.00 support.

Daily techs are firm bearish setup and support scenario, however, oversold slow stochastic suggests the pair may spend some time in consolidation before bears resume.

Extended upticks from new low at 105.24 are expected to stall under falling 10SMA (106.70) to keep bearish structure intact for fresh attempts lower.

Busy week is ahead with immediate focus turning towards today’s release of US ISM non-manufacturing PMI (Feb f/c 58.9 vs 59.9 in Jan) due later today; Japan’s Q4 GDP on Wednesday and key events of the week: BoJ rate decision and US jobs data on Friday.

Res: 105.67; 106.30; 106.70; 107.20

Sup: 105.35; 105.24; 105.00; 104.64