AUDUSD remains at the back foot, weighed by trade war fears; RBA rate decision / AUS retail sales in focus

The AUDUSD pair stands at the back foot in early Monday’s trading, but remains within the range established in past two days, showing little impact from better than expected Australian data, released overnight.

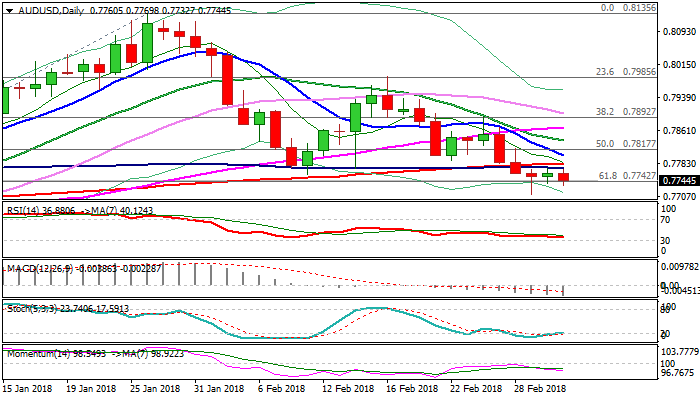

The upside remains capped by broken 100SMA (0.7773) which repeatedly limited recovery attempts from last week’s new low at 0.7712 (the lowest since late Dec 2017).

Fresh easing probes again through cracked pivotal Fibo support at 0.7742 (Fibo 61.8% of 0.7500/0.8135 rally), looking for close below to generate fresh bearish signal.

Firm break here would trigger further bearish acceleration which could stretch towards key short-term support at 0.7500 (11 Dec 2017 trough of broader ascend which commenced in early 2016).

Daily MA’s remain in firm bearish setup while 14-d momentum continues to trend lower, deeply in negative territory.

Violation of low at 0.77012 (reinforced by 20-d lower Bollinger band) would be strong bearish signal as the Aussie remains under pressure on rising uncertainty over Trump new tariffs.

Key releases for the Aussie dollar, RBA rate decision (forecasted unchanged at 1.5%) and Australian retail sales data (Jan f/c 0.4% vs -0.5% in Dec) are due early Tuesday and focused for fresh signals.

Res: 0.7773; 0.7785; 0.7803; 0.7837

Sup: 0.7732; 0.7712; 0.7700; 0.7650