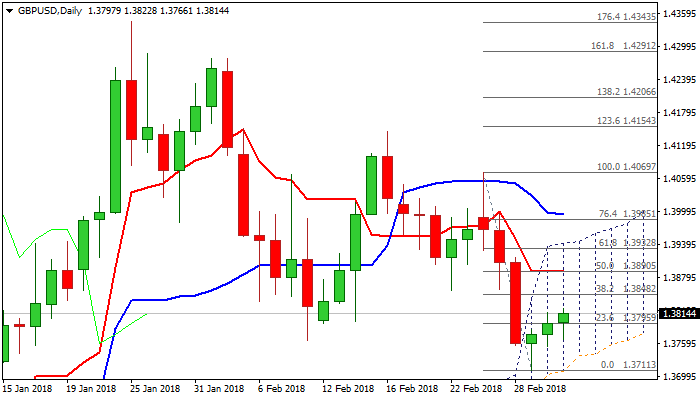

Upbeat UK data underpin recovery for test of key Fibo barrier at 1.3848

Cable stands at the front foot on Monday and attempts to extend recovery attempts from 1.3711 low (01 Mar) seen in past two days.

The price holds in the middle of daily cloud and ascend from 1.3711 low managed to move above rising 55SMA (1.3794), which would underpin the action for attack at the pivotal barrier at 1.3848 (Fibo 38.2% of 1.4070/1.3711 bear leg).

Better than expected UK services PMI (54.5 in Feb vs 53.3 f/c and 53.0 in Jan) offered fresh support.

Daily slow stochastic emerged from oversold territory and is supportive, but MA’s are in mixed mode and momentum studies are negative, which could affect near-term bulls.

However, break and close above 1.3848 Fibo barrier will be bullish signal for further upside action which could extend to 1.3890 (daily Tenkan-sen) and key barriers at 1.3932/44 (Fibo 61.8% of 1.4070/1.3711 / daily cloud top).

Meanwhile, the downside is expected to remain vulnerable while the price holds below 1.3848 pivot.

Bearish scenario sees recovery stall and renewed attempt at daily cloud base (1.3737), break of which would generate stronger bearish signal for extension of pullback from 1.4344 (2018 high, posted on 25 Jan).

Res: 1.3822; 1.3848; 1.3890; 1.3912

Sup: 1.3766; 1.3737; 1.3711; 1.3693