Risk aversion continues to drive the price higher; break through daily cloud top eyed for fresh bullish signal

Spot Gold holds in green on Monday and extends recovery from last week’s spike low at $1302.

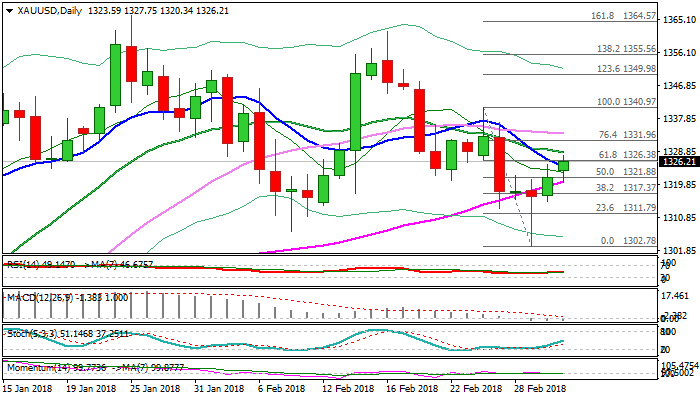

Fresh extension of two-day recovery broke above 10SMA ($1324) and pressures pivotal barriers at $1326/29 (Fibo 38.2% of $1340/$1302 downleg / 20SMA / daily cloud top), looking for fresh bullish signal on firm break higher.

Today’s action was held by rising 55SMA which was broken on Friday and now acts as solid support at $1320.

The yellow metal remains supported by fears of potential trade war and political uncertainty in Europe which sparked fresh risk-off mode and increased demand for safe-haven assets.

Fresh recovery moved gold price from dangerous territory and sidelined downside risk on violation of the lower boundary of broader consolidation range ($1366/07), after probe below range floor proved to be short-lived.

Gold price returned to the range and needs firm break above daily cloud to extend to the middle / upper part of the range on stronger bullish acceleration.

Little help is seen from technical studies so far as daily MA’s are in mixed setup; momentum and RSI are neutral, while slow stochastic trends higher, with price mainly driven by risk aversion.

Ascending 55SMA needs to keep the downside protected and maintain near-term bullish bias.

Res: 1329; 1332; 1336; 1340

Sup: 1324; 1320; 1315; 1313