USDJPY dips from the area near 160 on renewed intervention talks

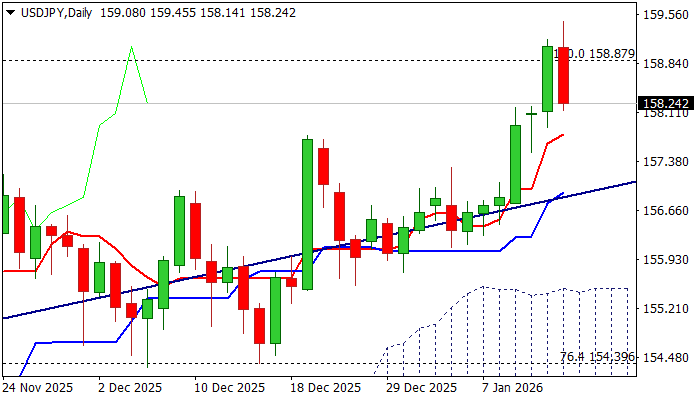

USDJPY eases from new multi-month high (159.45, the highest since mid-July 2024) on Wednesday.

The news that Japan’s PM is to call snap election in February, further deflated yen, but the following comments from Fin Min about intervention against yen’s excessive losses, cooled the situation and lifted Japan’s currency.

As expected, the pair faced strong headwinds on approach to 160 level, where market participants speculate Japan’s authorities could intervene, to support weakening currency.

Daily technical studies remain bullish overall but fading positive momentum and stochastic about to exit overbought zone, show space for further easing.

Former tops at 157.89/76 offer initial support, followed by broken upper boundary of larger bull-channel (157.00) which should ideally contain dips, to guard the top of rising daily Ichimoku cloud (155.50).

Violation of 160 barrier (in case Japan’s authorities do not intervene) could spark stronger acceleration higher, as large number of stops has been placed above this level.

Res: 157.53; 157.89; 158.20; 158.87

Sup: 157.76; 157.00; 156.11; 155.50