USDJPY – dollar remains well supported by wide gap between Fed and BoJ monetary policies

USDJPY remains steady, though at narrower range on Wednesday, awaiting the FOMC verdict later today.

Tuesday’s dip from new three-week high, which interrupted a six-day rally, is likely to be short-lived, as the dollar remains well supported and yen under pressure on wide gap between Fed and BoJ monetary policies.

Fed is expected to deliver a 25 basis points rate cut today, in an action that many see as hawkish cut due expected slowdown in policy easing in 2025, against previous estimations, while Japan’s policymakers will meet on Thursday and widely expected to keep interest rate unchanged.

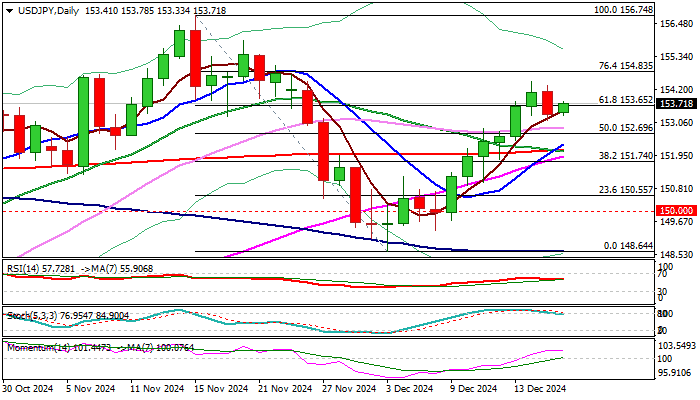

Bullish technical picture on daily chart adds positive outlook for the dollar (the action remains underpinned by rising thick daily Ichimoku cloud, MA’s create multiple bull-crosses and momentum is positive).

Firm break of cracked Fibo barrier at 153.65 (61.8% retracement of 156.74/148.64 pullback) to generate fresh bullish signal for acceleration towards 154.83 (Fibo 76.4%) and 156.74 (Nov 15 peak) in extension.

Res: 154.47; 154.83; 155.88; 156.74

Sup: 153.16; 152.87; 152.69; 152.30