USDJPY extends recovery but overall picture remains bearish

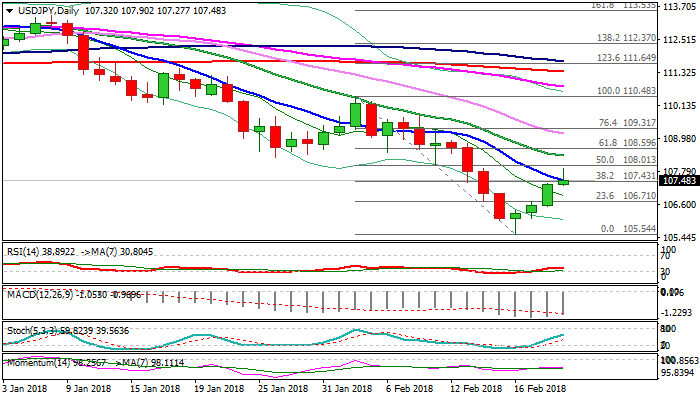

Recovery rally extends into fourth straight day and probed above pivotal barriers at 107.43/48 (Fibo 38.2% of 110.48/105.54 bear-leg / falling 10SMA) to hit one-week high at 107.90 (14 Feb high).

Bulls faced strong headwinds here and show initial signs of stall as falling 4-hr cloud (spanned between 107.51 and 108.25 weighs on near-term action.

Overall bearish structure keeps negative bias for fresh weakness after correction. Daily MA’s in firm bearish setup and 14-d momentum deeply in negative zone maintain negative outlook.

Strong barriers at 107.90 (recovery high) and 108.00 (50% of 110.48/105.54 downleg) should limit upside attempts before broader bears resume.

Conversely, lift above 108.00 will be initial bullish signal which needs confirmation on break and close above falling 4-hr cloud top (108.25) and descending 20SMA (108.36).

FOMC minutes are eyed for more clues about dollar’s near-term action.

Res: 107.90; 108.00; 108.36; 108.60

Sup: 107.43; 107.00; 106.72; 106.44