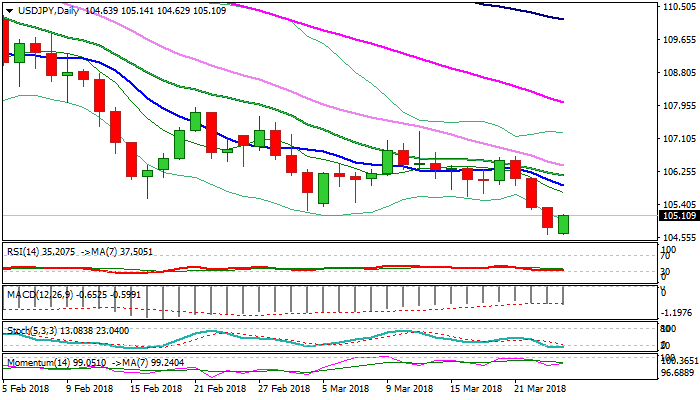

USDJPY may hold in extended consolidation before bears resume; falling 10SMA expected to cap upticks.

The pair bounced back to 105 zone in late Asian / early European trading after starting the week with 20-pips gap-lower and retesting Friday’s low at 104.63 (the lowest since November 2016).

Positive sentiment for Japanese currency persists on growing fears about global trade war which sparked risk-off trading and increased demand for safe-haven assets, as well as political crisis in Japan, which could deepen as Japanese PM Abe is due to testify in parliament on Tuesday.

The pair generated bearish signal on Friday’s close below psychological 105 support, which could result in further fall on triggering a number stops parked below.

Bears could extend significantly if situation with US tariffs deteriorates and could retest 101.20 (09 Nov 2016 low) as no significant supports lay en-route.

Bearish daily / weekly techs support scenario, but bears may enter consolidation phase before continuing lower.

Probes above 105 face solid barrier at 105.24 (former low of 02 Mar), with extended upticks to be seen as positioning for fresh downside, while capped by falling 10SMA (105.90).

Immediate downside risk would be sidelined on break above 10SMA, however, lift and close above 30SMA (106.40) is needed to turn near-term bias to the upside.

Res: 105.24; 105.45; 105.60; 105.90

Sup: 104.63; 104.04; 103.68; 103.20