USDJPY may rally further if Fed keeps aggressive stance

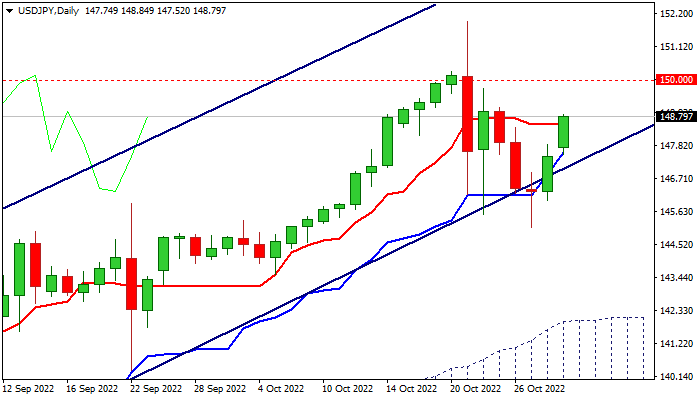

Completion of reversal pattern on daily chart signals that corrective pullback from new 32-year high (151.94) is over (following limited reaction from the latest intervention when Japan spent record amount to support weakening yen), as strong recovery extends into the second straight day.

Fresh bulls retraced over 50% of 151.94/145.10 pullback, adding to renewed bullish near-term stance, signaled by return of daily MA’s into full bullish setup and rising positive momentum.

Close above 148.52 (50% retracement of 151.94/145.10, reinforced by daily Tenkan-sen) would generate fresh bullish signal and keep recovery on track for test of 149.33 (Fibo 61.8%) and psychological 150 barrier.

Fundamentals also work in favor of the US dollar, as markets again price for 75 basis points Fed hike on Wednesday and expect the central bank to maintain hawkish stance towards 5% terminal rate, expected in the first quarter 2023.

Such scenario would further inflate the greenback and open way for further advance, exposing Fibo projections at 153.55 (123.6%) and 154.55 (138.2%) initially.

Res: 149.33; 150.00; 151.94; 153.55

Sup: 148.29; 147.37; 146.20; 145.10