WTI keeps firm tone for final clear break of $120 barrier

WTI oil keeps firm tone and probes above cracked $120 level on Wednesday, despite unexpected rise in US crude inventories by 2.02 million barrels against forecasted drop of 1.9 mln bls, with positive sentiment being boosted by easing demand concerns as China relaxes Covid restrictions and signals about possible strike of Norwegian oil workers.

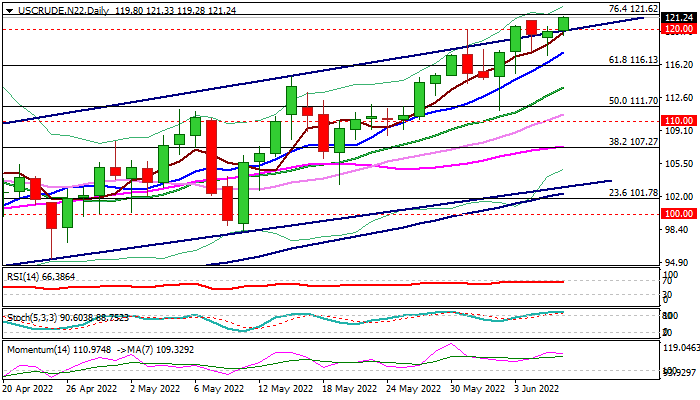

The contract maintains firm bullish stance, with attempts through the upper boundary line of larger bull-channel and through psychological $120 resistance to signal further advance.

Bulls pressure pivotal Fibo barrier at 121.62 (76.4% of $130.48/$96.92) break of which would expose target at $126.29 (Mar 9 high, posted before the price fell sharply) and unmask $130 zone (tested in early March).

Close above $120 is seen as a minimum requirement to signal bullish continuation after the price action was stuck in this zone in past three days, however, weaker momentum and overbought stochastic on daily chart warn of extended consolidation before bulls resume.

Res: 121.62; 122.20; 125.65; 126.29

Sup: 120.00; 119.28; 117.62; 117.15