Lira’s fall accelerates for likely retest of all-time low

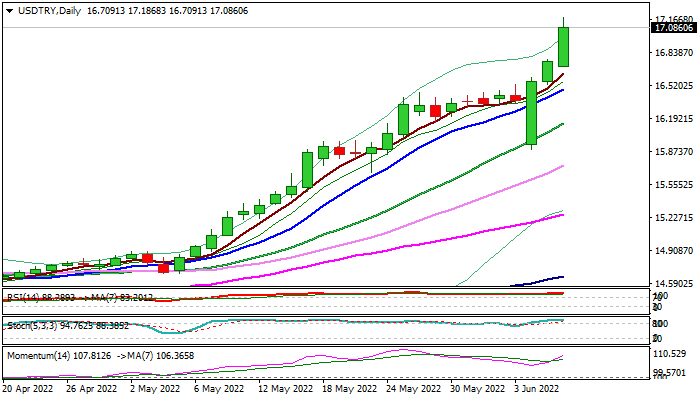

The USDTRY is in strong bullish acceleration for the third straight day (advancing 2.2% only today, as lira came under fresh and increased pressure on worries about skyrocketing inflation (73.5% in May), exhausted country’s reserves and persisting initiative by President Erdogan on further rate cuts.

Turkish lira lost around 27% of its value in the five months of 2022, as larger lira’s downtrend against the dollar since 2013, accelerated in early 2121 and hit a record low in December.

Bulls rose above pivotal Fibo resistance at 16.4182 (76.4% of 18.3387/10.2021 pullback) and on track for weekly close above this level that will confirm bullish signal and open way for retest of all-time high, with possibilities of further advance on break, as fundamental outlook in light of a record inflation, surging energy prices and a number of negative impacts from the conflict in Ukraine.

Overextended studies on all larger timeframes suggest bulls should take a breather, but these signals have so far been ignored, though the price action is very likely to face strong headwinds on approach to new record high.

Res: 17.1868; 17.2204; 17.3520; 175650

Sup: 17.0074; 16.7944; 16.7286; 16.6628