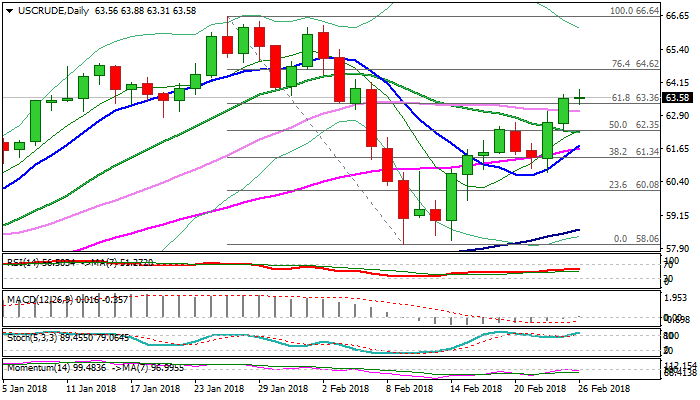

WTI OIL – bulls eye next targets at $64.27/62

WTI oil price is consolidating under new 2 ½ week high at $63.88, posted today, in extension of strong rally on Thu/Fri.

Oil price was boosted on Friday by closure of oil field in Libya, with strong bullish sentiment supported by comments by Saudi Arabia’s officials over the weekend, saying that the country would continue with reduced output, to support OPEC-led efforts to stabilize oil market by cutting global supplies.

Strong bullish signal was generated on Friday’s close above $63.36 pivot (Fibo 61.8% of $66.64/58.06 bear-leg), which would boost oil price for extension towards $64.16/27 (06/07 Feb double upside rejection) and 64.62 (Fibo 76.4% of $66.64/$58.06).

Supports at $63.36 (broken Fibo 61.8%) and $63.05 (30SMA) should ideally contain consolidation and keep immediate bulls intact.

Lower pivot lies at $62.26, provided by 20SMA and break here would sideline bulls and risk deeper pullback.

Res: 63.88; 64.27; 64.62; 65.00

Sup: 63.36; 63.05; 62.35; 62.26