WTI OIL eases on lowered tension over Syria / overbought studies

Oil price fell over 1% on Monday on growing signs that weekend air strikes on Syria were unlikely to escalate.

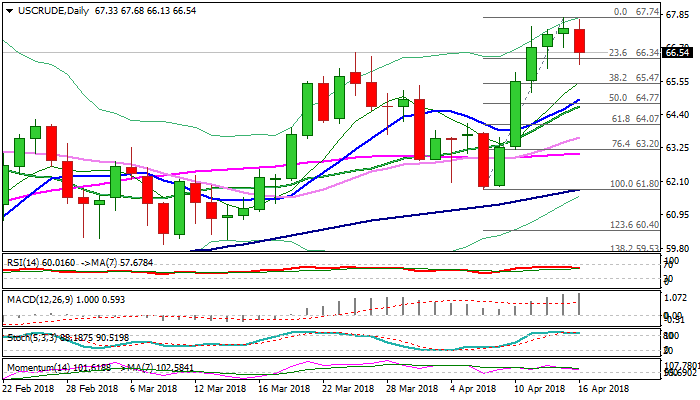

Rising geopolitical tensions sent oil price to the highest levels in over three years at $67.74 last week, which resulted in strongest weekly rally since late Nov 2016.

Bulls are taking a breather as tensions over Syria ease, with overbought conditions signaling that corrective action may extend.

Pullback from new high at $64.74 cracked initial support at $66.34 (Fibo 23.6% of $61.80/$67.74 rally) and approached round-figure support at $66.00 on Monday.

The price could dip further on bearish signal from south-turning daily RSI and strongly overbought slow stochastic which turns lower.

In addition, easing fears of stronger conflict in the Middle East and increasing US drilling activities weigh and keep oil price at the back foot.

Monday’s close in red would be initial negative signal for deeper pullback which could extend towards next strong support at $65.47 (Fibo 38.2% of $61.80/$67.74 rally).

Overall structure remains firmly bullish and sees current correction as positioning for fresh upside, as bulls eye psychological $70 barrier.

Such scenario favors limited corrective action, with extended dips to be contained above $65.47 support to keep bulls intact.

Conversely, bulls might be delayed further on break below $65.47 Fibo support and violation of rising 10SMA ($64.93).

Res: 66.64; 67.00; 67.74; 68.63

Sup: 66.43; 66.00; 65.47; 64.93