WTI oil remains under increased pressure after falling by 5.5% on Wednesday

WTI oil is about to resume the downtrend after a tight consolidation in early Thursday, following a sharp fall previous day (the contract was down 5.5% for the day in the biggest daily loss since 5 July 2022).

Renewed concerns about demand after the latest soft economic data raised possibilities of further slowdown in global economic growth, soured the sentiment.

The OPEC+ group held their meeting on Wednesday and left the oil output policy unchanged, as Saudi Arabia and Russia decided to keep their voluntary output cut by 1 million bpd and 300,000 bpd respectively, unchanged for the rest of the year.

Oil price fell to the lowest in over one month, with Wednesday’s sharp fall contributing to formation of reversal pattern on daily chart.

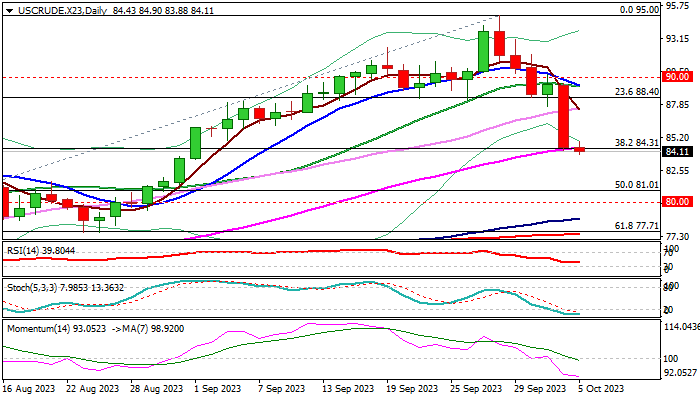

Fresh weakness probes through pivotal Fibo support at $84.31 (38.2% of $67.02/$95.00 rally, where the action on Wednesday found temporary footstep) signaling that larger bears from $95.00 (2023 top, posted on Sep 28) may resume.

Daily studies maintain very strong bearish momentum and Wednesday’s massive bearish daily candle weighs heavily, opening way for fresh drop towards targets at $81.00 zone (top of rising daily cloud / 50% retracement) and $80.00 (psychological) in extension.

On the other hand, 14-d momentum is overstretched and stochastic in oversold territory, warning that bears may start to lose traction, though upticks should be limited and offer better selling levels in current conditions.

Former consolidation floor and broken Fibo 23.6% at $88.00/40 zone should cap extended upticks to keep bears in play.

Res: 84.90; 86.00; 87.54; 88.00

Sup: 83.88; 81.71; 81.00; 80.00