Yen gains traction on risk aversion, doubts about Fed rate hikes

The pair stands at the back foot on Monday, as traders move to safety on growing Omicron concerns and market views that Fed’s planned rate hikes may not be achievable that weakens near-term sentiment.

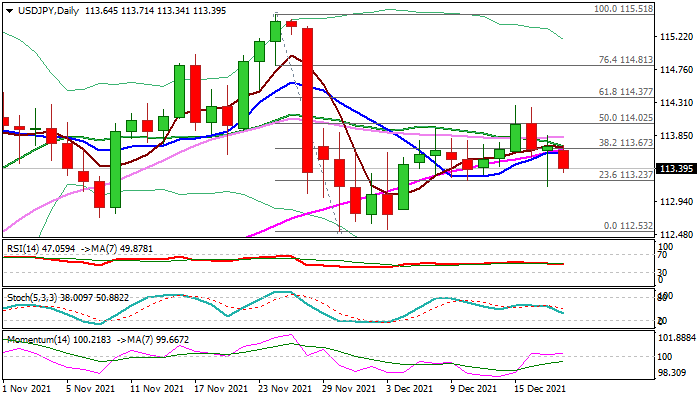

The action is also weighed by a double rejection above Fibo 50% of 115.51/112.53 bear-leg which signals formation of a bull-trap.

Daily techs are weakening as fresh weakness breaks below converged 10/55DMA’s, bringing daily moving averages into bearish setup and RSI turns south from neutrality zone.

Bears are on track for a daily close below pivotal Fibo support at 113.60 (Fibo 38.2% of 112.53/114.26) after triple failure, that would generate initial bearish signal and open way for retest of cracked Fibo 61.8% support (113.19), break of which is needed to confirm top and shift focus lower.

Res: 113.60; 113.85; 114.02; 114.37

Sup: 113.34; 113.19; 112.94; 112.53