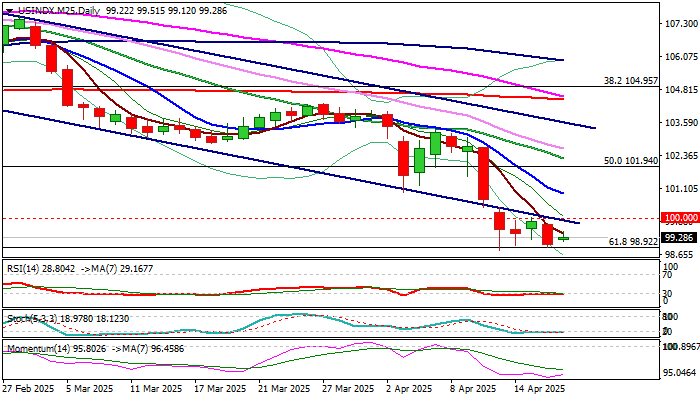

Dollar Index – narrow consolidation to precede fresh push lower while 100 level caps

The dollar index remains within a narrow consolidation above new multi-month low which extends into fifth consecutive day.

Larger bears are taking a breather after a sharp fall in past two weeks, when the dollar was deflated by imposed and subsequent delayed massive US import tariffs that dented investors’ confidence in US economic stability.

Technical pictures on daily and weekly charts show that bears hold grip firmly and remain ready to resume after a pause on extended Easter weekend.

Near-term price action continues to hold below broken 100 psychological support, which reverted to solid resistance and reinforced by broken lower trendline of larger bear-channel that keeps bearish bias and continues to pressure pivotal 99.00 support zone (Fibo 61.8% of 89.15/114.72 2021/2022 uptrend / recent lows) and 98.53 (100MMA).

Sustained break here to signal continuation of larger uptrend and expose target at 95.18 (Fibo 76.4%).

On the other hand, lift and close above 100 trigger would generate initial signal of stronger correction.

Res: 100.00; 100.42; 100.90; 101.23

Sup: 98.90; 98.68; 98.14; 97.81