Bears remain fully in play on US/China trade conflict fears/ stronger dollar

Copper extends downtrend into fourth straight day, driven lower by fears of deepening trade conflict between the US and China, which could have strong negative impact on global demand and stronger dollar on renewed risk appetite.

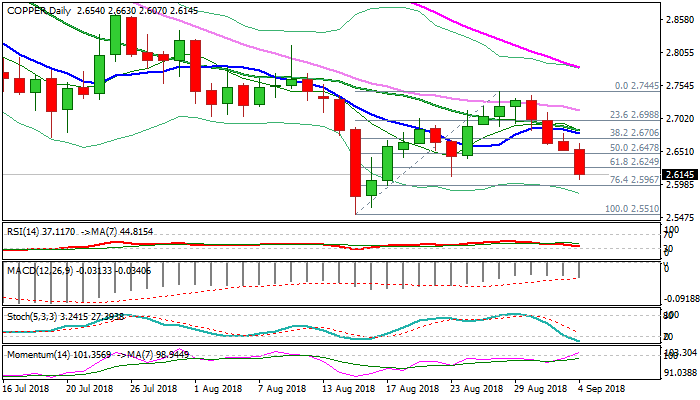

Today’s extension lower ( the metal was down 1.5% for the day so far) cracked significant supports at $2.6249 (Fibo 61.8% of $2.5510/$2.7445 upleg) and $2.6115 (23 Aug trough / weekly 200SMA), clear break of which would open way towards key support at 2.5510 (15 Aug low, the lowest since mid-June 2017), for full retracement of $2.5510/$2.7445 upleg).

Negative daily / weekly techs continue to support bears, however, strengthening momentum on daily chart could be an obstacle and may delay final push towards $2.5510 target.

Res: 2.6478; 2.6630; 2.6757; 2.6955

Sup: 2.6000; 2.5510; 2.5145; 2.5000