Sterling eases on Fresh Brexit news but remains constructive above converged 10/20SMA’s

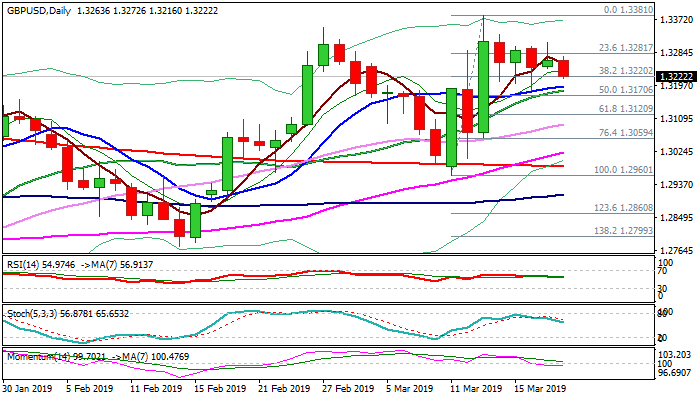

Cable moved lower in early European trading on Wednesday, hitting session low at 1.3225 and pressuring initial pivot at 1.3220 (Fibo 38.2% of 1.2960/1.3381 upleg), following narrow-range action in Asia.

Fresh comments about Brexit released this morning, talking about current frustration over parliament’s failure to make a decision and PM May unable to make significant adjustments to her plan, as well as comments about Brexit delay and revived fears of no-deal scenario, pushed pound lower.

Volatility rises as all possibilities (no-deal exit on 29 Mar; Brexit extension; parliament’s final approval of the plan; second Brexit referendum) remain on the table and maintain strong uncertainty among traders.

The price action of past few days holds in flag-shaped pattern, with north-turning momentum and MA’s bullish setup, maintaining slight bullish tone, but significant upside rejection on Tuesday warns that demand fades.

Pivotal supports at 1.3195/84 (converged 10/20SMA’s) stay intact for now and keep in play dip-buying scenario above here.

Stronger bearish signal could be expected on sustained break lower that would open way for further easing towards pivotal supports at 1.3120/1.3096 (Fibo 61.8% / 30SMA) and risk retest of key 200SMA support (1.2985).

Two important releases today are in focus for fresh signals. UK inflation is expected to remain unchanged at 1.8% in Feb (core CPI also at 1.9%), with Fed policy decision being the top event today.

Res: 1.3272; 1.3310; 1.3330; 1.3349

Sup: 1.3195; 1.3184; 1.3170; 1.3120