Dollar accelerates lower as solid US data boost risk appetite

The dollar fell against its main counterparts on Wednesday, following ADP jobs data miss, but strong upward revision of previous month’s figure and upbeat Manufacturing PMI in June that additionally boosted risk sentiment.

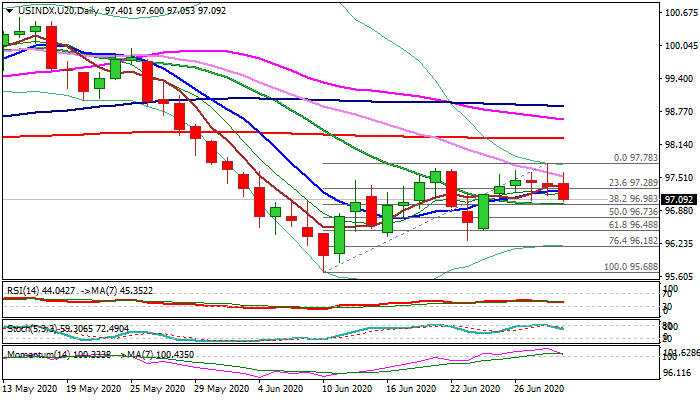

Fresh weakness emerges after triple-Doji signaled strong indecision and possible bulls’ stall, with double-top pattern forming on daily chart.

Pivotal support at 96.98 (20DMA / Fibo 38.2% of 95.68/97.78) is under pressure and firm break here would add to negative signals.

Fading bullish momentum and south-heading stochastic / RSI support scenario, with eventual close below 10DMA (97.23) which kept the downside protected in past four days, to generate initial bearish signal.

Res: 97.23; 97.53; 97.68; 97.78

Sup: 96.98; 96.73; 96.48; 96.30