Euro extends weakness after strong fall on Friday

The Euro remains firmly in red and extends weakness on Monday, despite solid German / EU PMI data, weighed by Friday’s massive bearish daily candle (the pair was down 0.84%, making the biggest one-day fall since 19 Mar 2020).

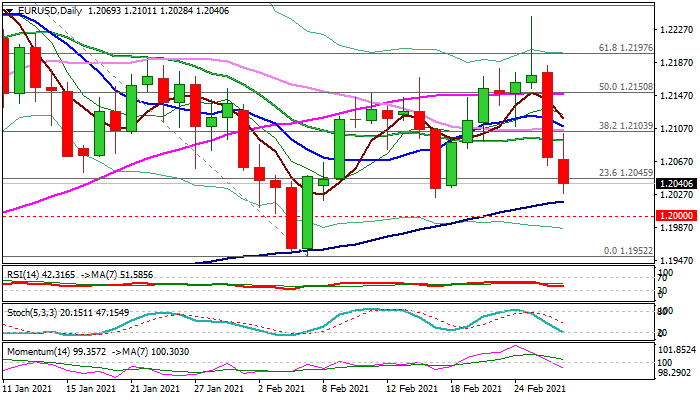

Fresh bears emerged after strong upside rejection last Thursday, as bulls got trapped above pivotal Fibo barrier at 1.2197 (61.8% of 1.2349/1.1952 descend).

Today’s break below the base of thick daily cloud (1.2047) generated strong bearish signal, which looks for confirmation on close below cloud base.

Bears face solid supports at 1.2018/00 (100DMA / psychological) and may take a breather here before resuming towards key near-term support at 1.1952 (Feb 5 trough).

Rising bearish momentum on daily chart signals that bears gained traction, with upticks expected to remain below 1.21 zone (converged 10/20/30DMA’s) to keep bearish structure intact.

Caution on bounce and close above 1.21 zone that would signal formation of a double-bottom and reversal.

Res: 1.2092; 1.2110; 1.2135; 1.2161

Sup: 1.2018; 1.2000; 1.1985; 1.1952