Bears resume after Fed and eye key 200WMA support

The pair extends weakness after near-term bears paused on Wednesday, hitting 1 ½ week low as dollar came under pressure after Fed minutes signaled that the central bank would stick to its ultra-accommodative policy until getting firmer signals that accelerating economic recovery is sustained.

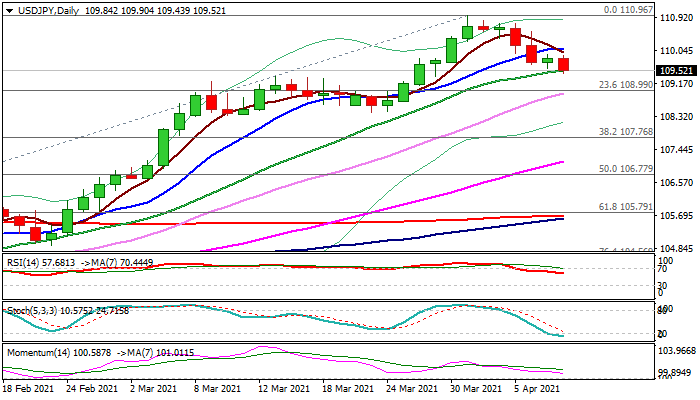

Fresh weakness probes through 20DMA (109.50) with daily close below here to further weaken near-term structure and bring in focus strong support at 108.98, provided by 200WMA.

Fading bullish momentum on daily chart supports scenario while more signals for deeper pullback could be seen on weekly chart, where RSI and stochastic are reversing from overbought zone and momentum turned south.

Profit-taking after strong rally in March, could further accelerate dollar’s weakness.

Broken 10DMA (110.09) marks solid barrier which needs to keep the upside limited and maintain bearish bias.

Res: 109.94; 110.09; 110.55; 110.74

Sup: 109.37; 108.98; 108.40; 107.80