Gold cracks pivotal barrier on fresh acceleration higher as dovish Fed deflated dollar

Spot gold hit three-week high on Thursday after Fed’s minutes showed that the central bank is going to keep ultra-low interest rates for some time that deflated dollar and US yields and boosted metal’s appeal.

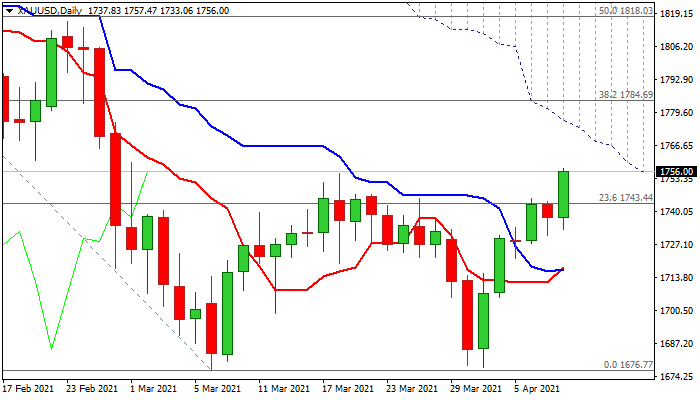

Fresh strength cracked pivotal barrier at $1755 (Mar 18 high) with firm break here to generate bullish signal on completion of double-bottom pattern ($1677).

Daily studies show momentum gaining traction and starting to head north after being in a range around the centerline for some days and moving averages (5/10/20/30) turned to bullish configuration, while stochastic is overbought and may provide headwinds.

Fresh bullish acceleration is heading towards strong barrier at $1773 (base of falling and thickening daily cloud), with penetration into cloud to generate fresh bullish signal for test of next key level at $1784 (Fibo 38.2% of $1959/$1676 descend).

Broken Fibo 23.6% barrier ($1723) reverted to solid support which is expected to keep the downside protected.

Only return below a cluster of converged daily MA’s (10/20/30) at $1729/25 zone would sideline bulls

Res: 1760; 1771; 1773; 1784

Sup: 1743; 1733; 1729; 1725